Bitcoin Trade Stop Loss Using Stop Losses As Soon As You Start Trading Digital Currency Helps Achieve Your Goals Quickly.

Bitcoin Trade Stop Loss. The Trailing Stop Or Any Stop Loss Is Vital In Managing Risk When.

SELAMAT MEMBACA!

If you are a beginner to trading bitcoin this video may help you not get liquidated.

A mental stop loss is referred to as a stop loss you remember to set before opening your trade.

This is unlike a standard stop loss which is manually set on a cryptocurrency exchange.

A mental stop loss only abides by the rules you put into action if your trade moves below your buy in price.

Of course, it could also go horribly wrong.

Using traditional trading tools sometimes works out for the best, but in a lot of cases, it is a losing move.

Stop orders, which are orders to buy or sell a security once it reaches a certain price, can help bitcoin investors lock in gains or limit losses.

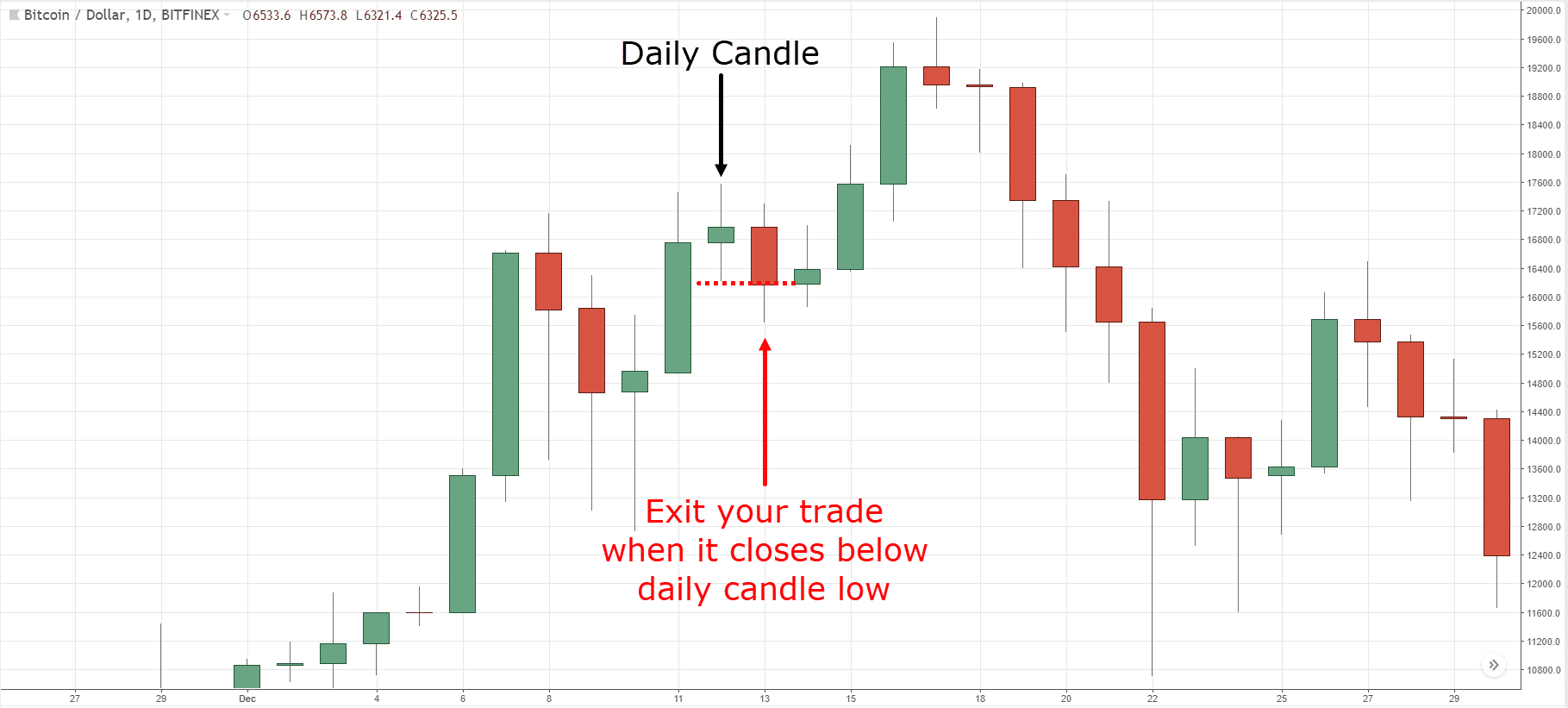

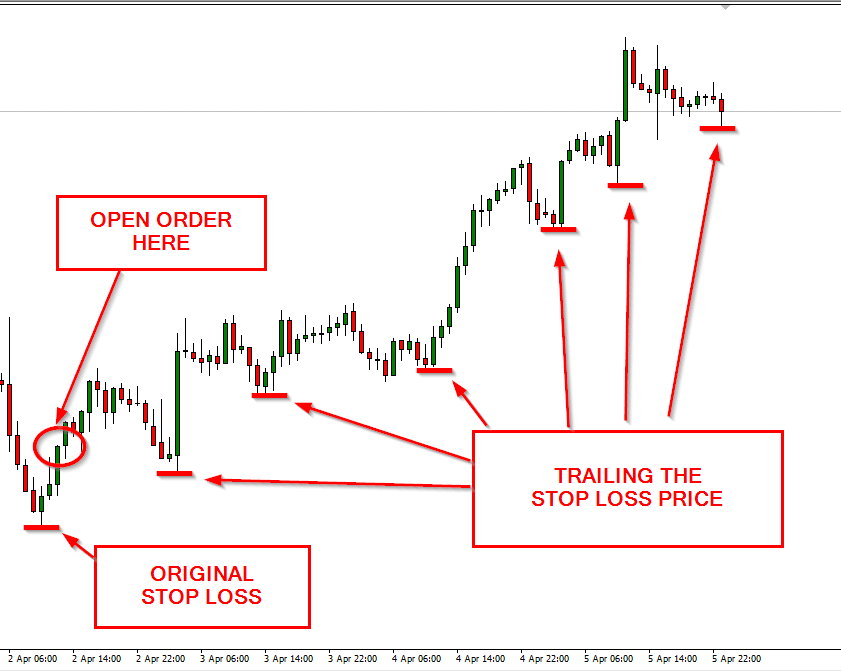

Exiting your open positions with (some kind of) trailing stop.

Stop loss can be extremely valuable in a swing market situation!

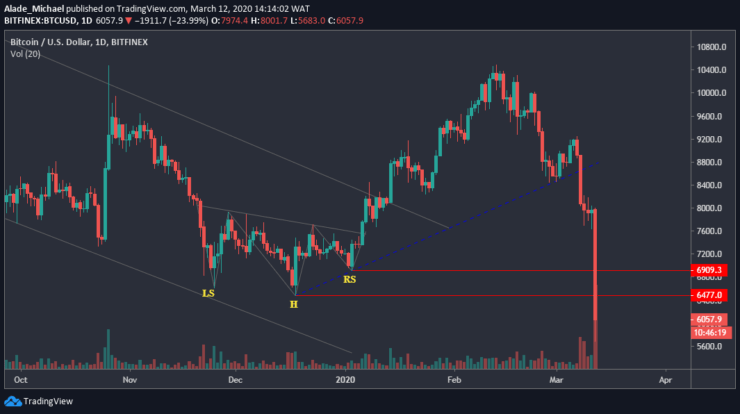

The perfect example is the bitcoin recent price action.

A stop loss order is crucial to be able to trade profitably in the long run.

A trader's goal cannot be to take profit on any single trade he ever does, as it's simply impossible to be 100% right every time with your estimation concerning price movements.

No trader in the world has a 100:0% ratio of profit to.

They will execute even if the desktop client is not running.

Www.bitrule.com assists bitcoin users to mitigate price volatility by placing custom trading rules such as stop loss as well as creating price alerts.

Only one trade without stop loss can burn your capital.

It is also a level from which some people will say that stop loss decreases the winning ratio.

Many traders argue to get 90% to 100% of winning trades.

Hmmm why not but do.

Traditional stop orders are therefore subject to the same fees as market orders and are subject to slippage.

Stop loss order can also be used for future trading.

Stop loss is a trading tool designed to limit the maximum loss of a trade by automatically liquidating assets once the market price reaches a specified value.

Bitcoin (btc) aims to provide a platform that is completely secure, infinitely scalable, and isp independent.

Due to recent regulatory changes in australia, coinspot can no longer offer their trading services to unverified international accounts.

Learn bitcoin trading best forex strategies works btc trading cryptocurrencies trading signals online guide for beginners bitcoin trading online ▶.read more:

Making money trading stocks takes time.

It is better to place a stop order immediately because sometimes the price can.

A stop loss top bitcoin brokers australia order is crucial to be able to trade profitably in the long run.

Home strategy for bitcoin trailing stop loss bitcoin trading strategy.

Stop loss is designed to be an exit order strategy to limit the amount of losses for a position.

Partial closure of position is not allowed.

Can be configured to be triggered by last traded price (last), index price (index) or mark price (mark).

If bitcoin is trading at $11,000 for quite a while, you may want to get more coins to gain profits in case the price increases in the future.

Using stop losses as soon as you start trading digital currency helps achieve your goals quickly.

Stop loss, as the name suggests it helps the users to control the loss from becoming worse.

These are the popular cryptocurrency exchange that offers stop losses for btc and other crypto trading.

As of feb 2019, there are 17.5 million bitcoins in circulation for a max cap of 21 million to be reached.

What is a stop loss order?

A stop loss order allows you to buy or sell once the price of an asset (e.g.

Btc) touches a specified price, known as the stop price.

Be excellent to each other.

You are expected to treat everyone with a certain level of respect.

Discussion should relate to bitcoin trading.

Don't have stop losses registered with the platform.

Better still don't be levered so highly you can't hodl through these fat moves.

Trading is basically the exchange of assets between a buyer and a seller.

Trade order types like market orders, limit orders and stop limit orders are the most common order types in trading.

This, in turn, will eventually lead to bad trading behavior and taking unnecessary losses.

Trading can be dangerous and trading using stop orders can help into either avoiding big losses or securing profits.

Trading bitcoin and crypto is similar to traditional stocks but comes with far greater risk and a few other important caveats every trader should know.

A trader has an invalidation level for their idea — price dropping significantly should invalidate their trade and cause their stop loss to fire!

Mengusir Komedo Membandel - Bagian 26 Khasiat Cengkih, Yang Terakhir Bikin HebohTekanan Darah Tinggi, Hajar Pakai Cincau HijauSalah Pilih Sabun, Ini Risikonya!!!Ternyata Madu Atasi InsomniaCara Benar Memasak SayuranJangan Buang Silica Gel!5 Khasiat Buah Tin, Sudah Teruji Klinis!!Ini Efek Buruk Overdosis Minum KopiMengusir Komedo MembandelThe stop loss is one of the basic tools of risk management for traders, as it can prevent major losses. Bitcoin Trade Stop Loss. Say that you have a stop loss on a stock set at £4.75.

If you are a beginner to trading bitcoin this video may help you not get liquidated.

A mental stop loss is referred to as a stop loss you remember to set before opening your trade.

This is unlike a standard stop loss which is manually set on a cryptocurrency exchange.

A mental stop loss only abides by the rules you put into action if your trade moves below your buy in price.

Of course, it could also go horribly wrong.

Using traditional trading tools sometimes works out for the best, but in a lot of cases, it is a losing move.

Stop orders, which are orders to buy or sell a security once it reaches a certain price, can help bitcoin investors lock in gains or limit losses.

Exiting your open positions with (some kind of) trailing stop.

Stop loss can be extremely valuable in a swing market situation!

The perfect example is the bitcoin recent price action.

A stop loss order is crucial to be able to trade profitably in the long run.

A trader's goal cannot be to take profit on any single trade he ever does, as it's simply impossible to be 100% right every time with your estimation concerning price movements.

No trader in the world has a 100:0% ratio of profit to.

They will execute even if the desktop client is not running.

Www.bitrule.com assists bitcoin users to mitigate price volatility by placing custom trading rules such as stop loss as well as creating price alerts.

Only one trade without stop loss can burn your capital.

It is also a level from which some people will say that stop loss decreases the winning ratio.

Many traders argue to get 90% to 100% of winning trades.

Hmmm why not but do.

Traditional stop orders are therefore subject to the same fees as market orders and are subject to slippage.

Stop loss order can also be used for future trading.

Stop loss is a trading tool designed to limit the maximum loss of a trade by automatically liquidating assets once the market price reaches a specified value.

Bitcoin (btc) aims to provide a platform that is completely secure, infinitely scalable, and isp independent.

Due to recent regulatory changes in australia, coinspot can no longer offer their trading services to unverified international accounts.

Learn bitcoin trading best forex strategies works btc trading cryptocurrencies trading signals online guide for beginners bitcoin trading online ▶.read more:

Making money trading stocks takes time.

It is better to place a stop order immediately because sometimes the price can.

A stop loss top bitcoin brokers australia order is crucial to be able to trade profitably in the long run.

Home strategy for bitcoin trailing stop loss bitcoin trading strategy.

Stop loss is designed to be an exit order strategy to limit the amount of losses for a position.

Partial closure of position is not allowed.

Can be configured to be triggered by last traded price (last), index price (index) or mark price (mark).

If bitcoin is trading at $11,000 for quite a while, you may want to get more coins to gain profits in case the price increases in the future.

Using stop losses as soon as you start trading digital currency helps achieve your goals quickly.

Stop loss, as the name suggests it helps the users to control the loss from becoming worse.

These are the popular cryptocurrency exchange that offers stop losses for btc and other crypto trading.

As of feb 2019, there are 17.5 million bitcoins in circulation for a max cap of 21 million to be reached.

What is a stop loss order?

A stop loss order allows you to buy or sell once the price of an asset (e.g.

Btc) touches a specified price, known as the stop price.

Be excellent to each other.

You are expected to treat everyone with a certain level of respect.

Discussion should relate to bitcoin trading.

Don't have stop losses registered with the platform.

Better still don't be levered so highly you can't hodl through these fat moves.

Trading is basically the exchange of assets between a buyer and a seller.

Trade order types like market orders, limit orders and stop limit orders are the most common order types in trading.

This, in turn, will eventually lead to bad trading behavior and taking unnecessary losses.

Trading can be dangerous and trading using stop orders can help into either avoiding big losses or securing profits.

Trading bitcoin and crypto is similar to traditional stocks but comes with far greater risk and a few other important caveats every trader should know.

A trader has an invalidation level for their idea — price dropping significantly should invalidate their trade and cause their stop loss to fire!

The stop loss is one of the basic tools of risk management for traders, as it can prevent major losses. Bitcoin Trade Stop Loss. Say that you have a stop loss on a stock set at £4.75.Segarnya Carica, Buah Dataran Tinggi Penuh KhasiatKhao Neeo, Ketan Mangga Ala ThailandResep Cream Horn PastryBuat Sendiri Minuman Detoxmu!!Resep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangCegah Alot, Ini Cara Benar Olah Cumi-CumiTernyata Asal Mula Soto Bukan Menggunakan Daging3 Cara Pengawetan Cabai7 Makanan Pembangkit LibidoBir Pletok, Bir Halal Betawi

Komentar

Posting Komentar