Bitcoin Trade Stop Loss The Market Is Open 24/7.

Bitcoin Trade Stop Loss. Discussion Should Relate To Bitcoin Trading.

SELAMAT MEMBACA!

Trading bitcoin and other cryptocurrencies can be a very profitable endeavor.

Using traditional trading tools sometimes works out for the best, but in a lot of cases, it is a losing move.

A mental stop loss is referred to as a stop loss you remember to set before opening your trade.

This is unlike a standard stop loss which is manually set on a cryptocurrency exchange.

If you are a beginner to trading bitcoin this video may help you not get liquidated.

The trailing stop or any stop loss is vital in managing risk when.

Stop orders, which are orders to buy or sell a security once it reaches a certain price, can help bitcoin investors lock in gains or limit losses.

Whenever i think the market may be down then i gave stop loss.when the bitcoin is pumping, the altcoins are likely to be dumping.altcoins are pump when bitcoin stable.stop loss will generally use.

A stop loss should be used in your bitcoin trading around levels that can help keep you in a trade, rather than just being viewed as a mean to get you out if your first level is wrong.

The stop loss orders on btx trader are hosted on the backend.

Www.bitrule.com assists bitcoin users to mitigate price volatility by placing custom trading rules such as stop loss as well as creating price alerts.

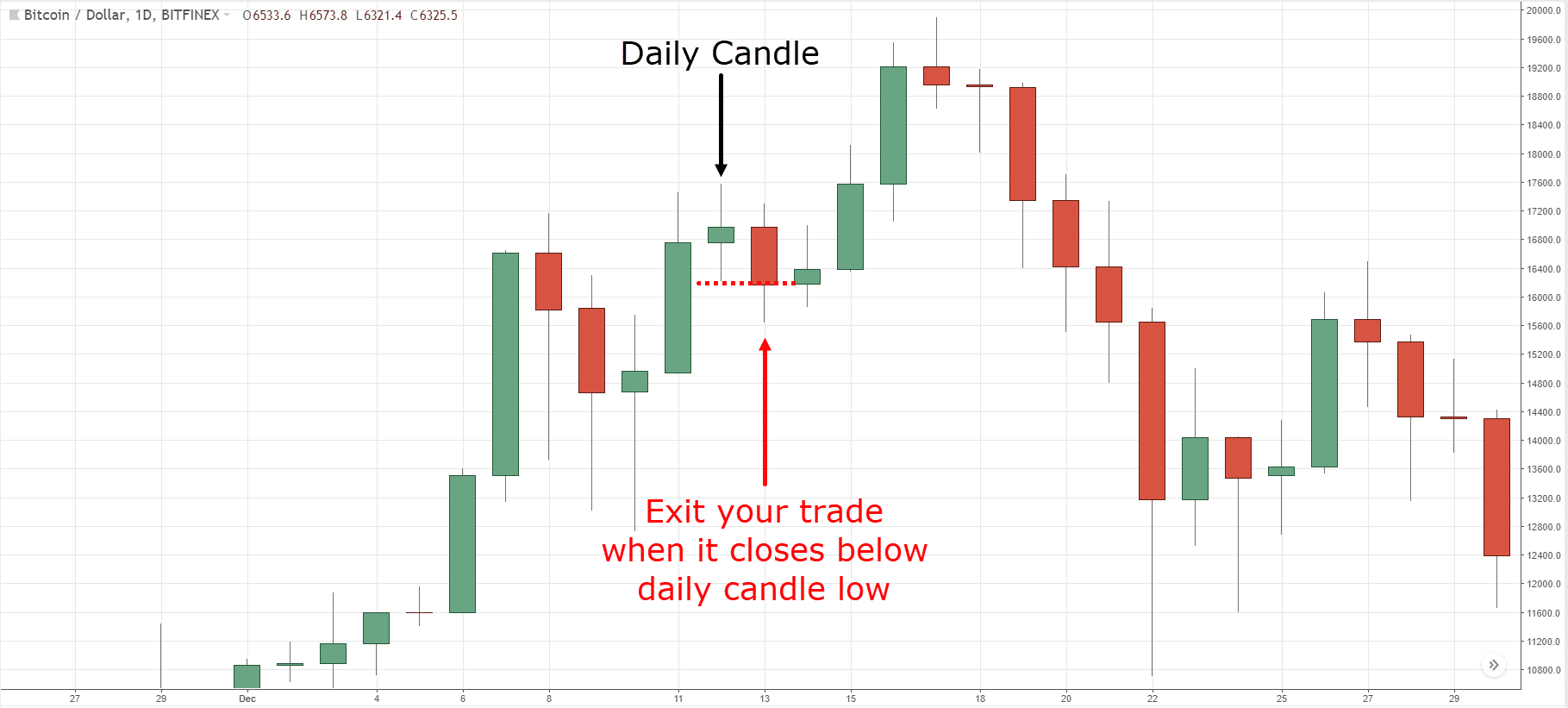

Exiting your open positions with (some kind of) trailing stop.

A stop loss order is crucial to be able to trade profitably in the long run.

No trader in the world has a 100:0% ratio of profit to.

Stop loss is a trading tool designed to limit the maximum loss of a trade by automatically liquidating assets once the market price reaches a specified value.

There are multiple types of stop loss that can be used in different scenarios depending on the crypto market situation.

A stop loss is an indispensable tool allowing you to limit your losses.

It is also a level from which some people will say that stop loss decreases the winning ratio.

Many traders argue to get 90% to 100% of winning trades.

Learn bitcoin trading best forex strategies works btc trading cryptocurrencies trading signals online guide for beginners bitcoin trading online ▶.if you are you having a hard time cutting your bitcoin trading losses once you're in a trade and it turns against you today, i'm going to share three.

Coinbase introduces stop orders for bitcoin exchange traders.

Traditional stop orders are therefore subject to the same fees as market orders and are subject to slippage.

Bitcoin (btc) aims to provide a platform that is completely secure, infinitely scalable, and isp independent.

Due to recent regulatory changes in australia, coinspot can no longer offer their trading services to unverified international accounts.

Stop loss is designed to be an exit order strategy to limit the amount of losses for a position.

Will be executed as a stop loss market order.

Can be configured to be triggered by last traded price (last), index price (index) or mark price (mark).

If bitcoin is trading at $11,000 for quite a while, you may want to get more coins to gain profits in case the price increases in the future.

As a beginner, it's recommended to use market orders first because.

A stop loss top bitcoin brokers australia order is crucial to be able to trade profitably in the long run.

A stop loss should be used in your bitcoin trading around levels that can help keep you in a trade, rather than just being viewed as a mean to get you out if your.

Your cold wallet is up and running.

Hardware wallets are suggested for complete peace of first learn not to lose.

Learn the algorithms that mitigate the losses and maximize the gains.

Stop loss, as the name suggests it helps the users to control the loss from becoming worse.

These are the popular cryptocurrency exchange that offers stop losses for btc and other crypto trading.

As of feb 2019, there are 17.5 million bitcoins in circulation for a max cap of 21 million to be reached.

Stop loss orders offers traders a level of protection when trading on kraken (with or without the use of margin).

What is a stop loss order?

A stop loss order allows you to buy or sell once the price of an asset (e.g.

This, in turn, will eventually lead to bad trading behavior and taking unnecessary losses.

When you trade bitcoin (btc) for litecoin (ltc) all that happens is an accounting system tells you how many you had then, and how many you have now.

Don't have stop losses registered with the platform.

On my fidelity account when i want to place a stop loss or a stop limit order i enter a trigger price that is lower than the current price and.

Be excellent to each other.

You are expected to treat everyone with a certain level of respect.

Stocks rose monday to recover some of last week's losses, with investors' concerns over inflation at technology stocks outperformed as treasury yields retreated.

If our stop loss order is filled we will face 40 usdt loss on our 500 usdt trade.

In placing a stop loss, a confirmation window always appear before stop loss is a must for any style of trading.

Trading can be dangerous and trading using stop orders can help into either avoiding big losses or securing profits.

A classic fast ema crosses over a slow ema approach will be used.

The market is open 24/7.

Bitcoin futures trading & spot trading.

Ternyata Inilah HOAX Terbesar Sepanjang MasaAwas!! Ini Bahaya Pewarna Kimia Pada MakananSalah Pilih Sabun, Ini Risikonya!!!Saatnya Bersih-Bersih UsusMulai Sekarang, Minum Kopi Tanpa Gula!!Ini Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatTips Jitu Deteksi Madu Palsu (Bagian 1)Obat Hebat, Si Sisik NagaAwas, Bibit Kanker Ada Di Mobil!!Saatnya Minum Teh Daun Mint!!When did bitcoin trading get so popular? Bitcoin Trade Stop Loss. Bitcoin futures trading & spot trading.

Stop loss is a trading tool designed to limit the maximum loss of a trade by automatically liquidating assets once the market price reaches a specified value.

A mental stop loss will test your trading discipline.

Trust me, when those dips get deeper, that panic button starts to look more and more enticing.

However mentally strong you think you are, it's nothing compared to the feeling you'll get once that dip accumulates more sizable losses.

Navigate to a trading pair and select stop loss under the advanced dropdown menu.

This is the amount of crypto you want to trade.

Here is your chance to know these tools and learn their usage.

Stop loss orders offers traders a level of protection when trading on kraken (with or without the use of margin).

When the last traded price touches the stop price, the stop loss order will execute immediately as a market order and will incur taker fees upon execution.

When we deal with such an unstable market as the cryptocurrency market, the most difficult task is to limit losses.

You've opened a trade with the following settings:

The tsl needs to be activated by something called the arm.

Crypto trading bot & terminal aimed at unifying all crypto exchanges and provides trading terminal offering many advanced order types using bot assistance like trailing stop buy/sell best crypto trading terminal & bot.

A big trading loss is painful, no doubt about that.

You play this game to win.

With the right mindset and discipline you can compensate your loss over time and even become a successful crypto trader if you pursue this.

He decides to set a stop loss at $9,200 17/01/2019 · #stoploss #crypto #trading learning the proper basics of trading is the only way you will make consistent profits in the crypto market.

Stop loss orders are designed to limit an investor's loss on a position in a security.

Using a good stop loss strategy can make you look as cool as the guy sipping his scotch in that gif (how do i know it's scotch?

Stop loss is a tool/function to buy or sell a cryptocurrency once its price reaches a specified level, commonly known as 'the stop price'.

Stop loss is an extremely important tool for traders that serves as protection from excessive losses in the trading process.

They are placed on a trading platform and can be left open for a day (daily order) or forever (good till.

You don't have to use stops in a way that results in a loss.

That is the basics of using stops when trading crypto.

Stops can be an excellent tool, but if you don't use them correctly you can end up eroding your.

While stop losses aim to reduce the potential loss of a trade, it is not always advantageous within the cryptocurrency market.

In this case, if a coin is indicated to increase in price, an investor might.

Stoploss — check out the trading ideas, strategies, opinions, analytics at absolutely no cost!

You may apply a stop loss order after the position is opened, according to the instrument's rate or to a specific amount.

On cryptocurrency trades that are in profit, the minimum stop loss amount is 25% of the initial amount invested subtracted from the current value of the trade.

The formula is as follows

Topics can range from exchanges, technical analysis, to fundamental analysis.

Submitted 3 years ago by theodore_70.

Stop_loss = askparam 'stop loss % or price', 2 take_profit = askparam 'take profit % or price', 0.

I intend to use this script on alts trading mainly.

Alts will likely go down when bitcoin goes up too quick therefore this stop is for sell everything when btc.

The same is true if the trader is looking to buy bitcoin — they can set a this functionality is particularly useful in crypto markets due to their 24/7 nature, allowing traders.

Zero crypto exchanges support trailing stop limit orders.

The cryptocurrency stop loss strategy is an effective trading system designed to get out of the crypto market when severe markets dips make trade setup. Bitcoin Trade Stop Loss. Zero crypto exchanges support trailing stop limit orders.Nikmat Kulit Ayam, Bikin SengsaraResep Ayam Kecap Ala CeritaKulinerSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanResep Yakitori, Sate Ayam Ala JepangSejarah Gudeg JogyakartaResep Segar Nikmat Bihun Tom YamTips Memilih Beras BerkualitasPetis, Awalnya Adalah Upeti Untuk Raja3 Jenis Daging Bahan Bakso TerbaikIkan Tongkol Bikin Gatal? Ini Penjelasannya

Komentar

Posting Komentar