Bitcoin Trade Stop Loss Will Be Executed As A Stop Loss Market Order.

Bitcoin Trade Stop Loss. Many Traders Argue To Get 90% To 100% Of Winning Trades.

SELAMAT MEMBACA!

Trading bitcoin and other cryptocurrencies can be a very profitable endeavor.

Using traditional trading tools sometimes works out for the best, but in a lot of cases, it is a losing move.

A mental stop loss is referred to as a stop loss you remember to set before opening your trade.

This is unlike a standard stop loss which is manually set on a cryptocurrency exchange.

A stop loss should be used in your bitcoin trading around levels that can help keep you in a trade, rather than just being viewed as a mean to get you out if your first level is wrong.

Stop orders, which are orders to buy or sell a security once it reaches a certain price, can help bitcoin investors lock in gains or limit losses.

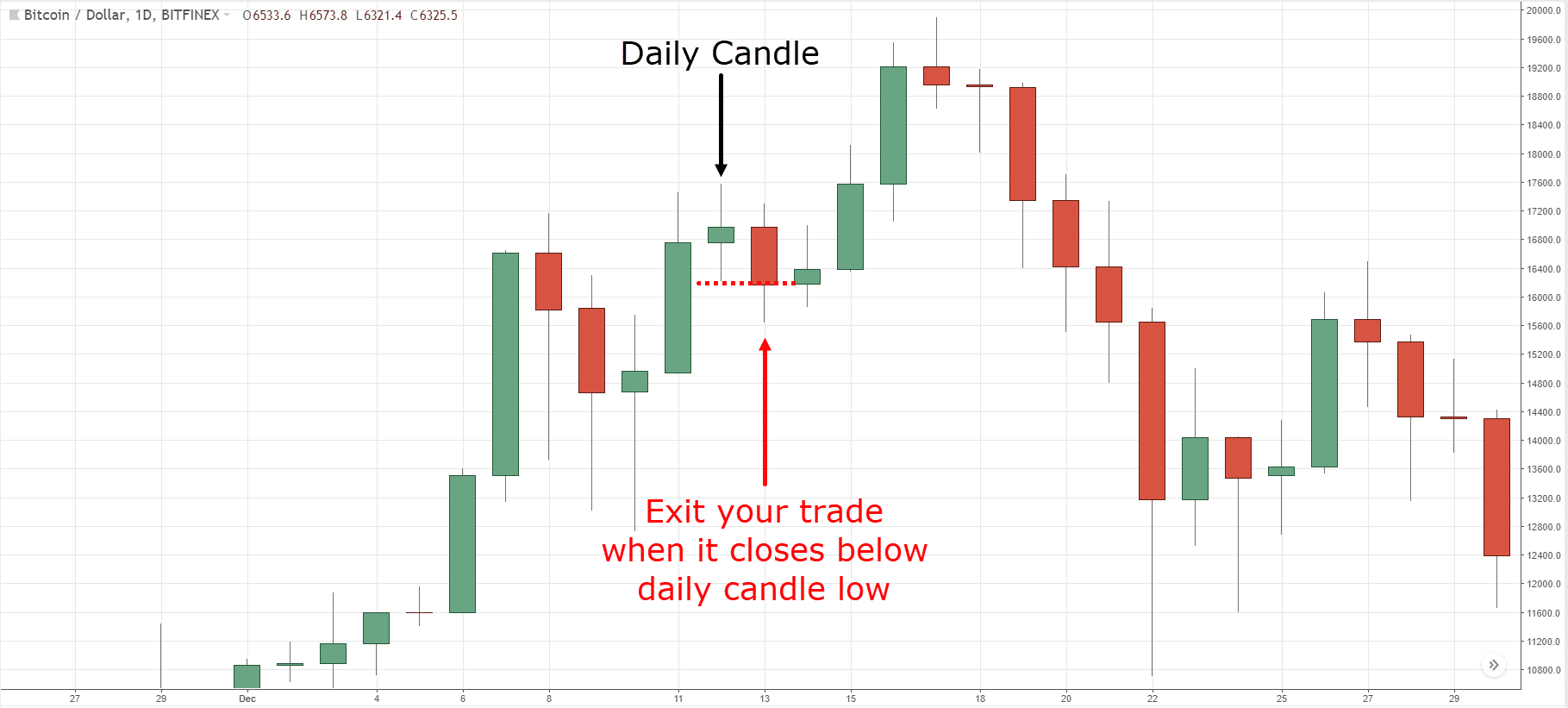

Exiting your open positions with (some kind of) trailing stop.

Whenever i think the market may be down then i gave stop loss.when the bitcoin is pumping, the altcoins are likely to be dumping.altcoins are pump when bitcoin stable.stop loss will generally use.

The stop loss orders on btx trader are hosted on the backend.

They will execute even if the desktop client is not running.

A stop loss order is crucial to be able to trade profitably in the long run.

A trader's goal cannot be to take profit on any single trade he ever does, as it's simply impossible to be 100% right every time with your estimation concerning price movements.

No trader in the world has a 100:0% ratio of profit to.

Due to recent regulatory changes in australia, coinspot can no longer offer their trading services to unverified international accounts.

Only one trade without stop loss can burn your capital.

A stop loss is an indispensable tool allowing you to limit your losses.

Many traders argue to get 90% to 100% of winning trades.

Hmmm why not but do.

Stop loss is a trading tool designed to limit the maximum loss of a trade by automatically liquidating assets once the market price reaches a specified value.

Coinbase introduces stop orders for bitcoin exchange traders.

Traditional stop orders are therefore subject to the same fees as market orders and are subject to slippage.

Stop loss order can also be used for future trading.

What is a stop loss order?

A stop loss order allows you to buy or sell once the price of an asset (e.g.

Btc) touches a specified price, known as the stop price.

Using stop losses as soon as you start trading digital currency helps achieve your goals quickly.

As a beginner, it's recommended to use market orders first because.

It is better to place a stop order immediately because sometimes the price can.

These are the popular cryptocurrency exchange that offers stop losses for btc and other crypto trading.

As of feb 2019, there are 17.5 million bitcoins in circulation for a max cap of 21 million to be reached.

Stop loss is designed to be an exit order strategy to limit the amount of losses for a position.

Will be executed as a stop loss market order.

Can be configured to be triggered by last traded price (last), index price (index) or mark price (mark).

Learn bitcoin trading best forex strategies works btc trading cryptocurrencies trading signals online guide for beginners bitcoin trading online ▶.read more:

Making money trading stocks takes time.

Bitcoin trading and stop order.

Bitcoin is a cryptocurrency which is increasingly being used for trading.

On my fidelity account when i want to place a stop loss or a stop limit order i enter a trigger price that is lower than the current price and.

Be excellent to each other.

You are expected to treat everyone with a certain level of respect.

A stop loss top bitcoin brokers australia order is crucial to be able to trade profitably in the long run.

A stop loss should be used in your bitcoin trading around levels that can help keep you in a trade, rather than just being viewed as a mean to get you out if your.

Home strategy for bitcoin trailing stop loss bitcoin trading strategy.

The stop loss is one of the basic tools of risk management for traders, as it can prevent major losses.

Say that you have a stop loss on a stock set at £4.75.

Jam Piket Organ Tubuh (Hati)5 Makanan Tinggi KolagenAwas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`Multi Guna Air Kelapa Hijau5 Manfaat Habbatussauda Untuk Pria Dan Wanita, Yang Terakhir Wajib DibacaCegah Celaka, Waspada Bahaya Sindrom HipersomniaTak Hanya Manis, Ini 5 Manfaat Buah SawoTernyata Menikmati Alam Bebas Ada ManfaatnyaObat Hebat, Si Sisik NagaTips Jitu Deteksi Madu Palsu (Bagian 1)Trading without a stop loss:a stop loss order is an order to buy or sell a given security at a specific price, once the for example, in the forex market, a trailing stop may be set a certain number of pips geometric patterns can all be implemented into a trailing stop trade strategy. Bitcoin Trade Stop Loss. As you anticipate the price of bitcoin to fall, you sell 10 cfds at the.

A mental stop loss will test your trading discipline.

Transform your diminishing crypto account into a powerhouse portfolio in under 60 days with our highly profitable crypto account.

Limiting your losses will be the best thing you've ever done.

Measure your progress and losses.

Crypto trader josh olszewicz offers some basic tips and tricks to help both beginner and intermediate.

Home » cryptocurrency » trading » understanding stop loss in crypto trading.

Using stoploss the correct way can maximize your profit.

You can really book your fortune while trading without doing much.

In crypto without trading knowledge and controlling emotions, you are screwed very fast, this market doesn't give if you not setting up a stop loss on binance spot trading and price of a coin fall from your entry point, you may sit for months waiting for your coin price to come back to your entry price.

Stop loss is a trading tool designed to limit the maximum loss of a trade by automatically liquidating assets once the market price reaches a specified value.

Stop loss is a tool/function to buy or sell a cryptocurrency once its price reaches a specified level, commonly known as 'the stop price'.

Stop loss is an extremely important tool for traders that serves as protection from excessive losses in the trading process.

You can essentially still trade crypto without commission by using robinhood to trade crypto or by trading grayscale trusts (like gbtc) with some brokers (some brokers charge fees, others don't;

Cryptocurrency traders use crypto trading bots to automate their investments and maximize their profits while trading.

When used with other risk management tools, a crypto trading bot can help take some of the emotion out of your trading strategy.

Trading without stop losses might sound like the riskiest thing there is.

Moreover, as i explain below your stop losses may not actually be providing you with the protection that you.

Learn to trade like a pro.

A big trading loss is painful, no doubt about that.

Be aware of your mistake and keep it in mind so you never hold any coin again that long, without a stop loss.

Stop loss orders offers traders a level of protection when trading on kraken (with or without the use of margin).

What is a stop loss order?

It is better to place a stop order immediately because sometimes the price can.

Crypto trading signals are trading ideas or trade suggestions to buy or sell a particular coin at a certain price and time.

Check out our discord chat server, sourcecrypto, for more up to the minute collaborative curation.

If you have any questions freely ask here.

Stop loss is really great feature in trading and every exchange provide this feature for their traders, because they don't face huge loss when their.

Enjoy increased leverage without risk of liquidation.

Take profit works in a similar way — setting this level means signaling to the broker that you wish your position it might not be completely clear why a trader needs to set these levels, instead of trading without them.

A trailing stop loss (tsl) is placed just like an ordinary stop loss when entering a position;

The when should i use a trailing stop loss?

Why not use it all ultimately, i made $142 on this exact trade since using a tsl enabled me to ride the rally until it.

Importance of stop loss orders a stop loss order is crucial to be able to trade profitably in the long […] it's also important not to set the stop loss too tight, as the current volatility could execute it without reason.

A price has to have the opportunity to move around the entry within a certain range.

I'm in awe of traders who trade without stoploss (by this i mean let it run till a margin call) personally i have no way of ever knowing a 100% which way price will go thats why personally i always use a stop loss.

Top crypto growth posted on september 23, 2018 by cryptoguyjanuary 22, 2019.

Powerful strategies to profit in bull & supply and demand trading secrets. Bitcoin Trade Stop Loss. Professional price action trading patterns that work.Sensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanTernyata Inilah Makanan Indonesia Yang Tertulis Dalam Prasasti7 Makanan Pembangkit LibidoResep Cream Horn Pastry3 Jenis Daging Bahan Bakso TerbaikResep Ayam Suwir Pedas Ala CeritaKulinerResep Kreasi Potato Wedges Anti GagalResep Nikmat Gurih Bakso LeleResep Segar Nikmat Bihun Tom YamPetis, Awalnya Adalah Upeti Untuk Raja

Komentar

Posting Komentar